IOD Leadership Conference 2023

Welcome to this summary of the IOD Leadership Conference. It was held on 4th and 5th of May 2023 in Auckland with around 600 people. With more than 10,000 members, the IOD are the leading governance focussed group in New Zealand and I know them well as a facilitator on legal risks for their ‘Company Director Course’, and host of their podcast ‘Board Matters’ (13 short episodes with experienced Directors).

Idealog has published a version of this summary here: Emerging trends from IOD Governance Conference – Idealog

This is a summary of the key speakers and topics because some of you would like to have attended the event but could not – now you can get a sense of what was discussed and learn as well. Also, some of you attended, but were in different breakouts, so now you can see what was going on in others!

It was a really great two days and encourage you to attend in person next year – in Christchurch! You cannot beat the superior experience of making connections, networking and ability to ask lots of questions from attending! But since this one is done and dusted, this summary may show why, and the subjects may impact your perception of IOD and surprise as to what they are highlighting. A lot of it matches themes I talk about on Seeds all the time, so I was pleased to see what was being discussed!

In case you are eager for more content, drop me a line to be added to my email list stevenmoe@parryfield.com, and then for the summary of the 2021 Conference, it is here and I welcome connecting on LinkedIn here. Also, if you are after stimulating thinking then why not look around this seeds podcast site with videos, articles and podcast (you are on here now). Note the Seeds Impact Conference is coming up online – only $20 to attend and seeking more supporters, now have 160+ on the site, including IOD who will present.

Tim Groser: Entering uncharted waters?

100 years ago in the 1920s there were the “roaring twenties” that captured the mood of that time – bouncing back from WWI. So what are the things happening today to shape us?

- Geopolitics is back: Russia and Ukraine is a big deal, because it is the first time in 70 years the boundaries of Europe have been put into question.

- We have passed peak globalisation.

- US Dollar dominance is under serious challenge.

- The ‘Just in Time’ business model is being replaced by ‘resilient’ business models.

- The institutions of globalisation are in a weak position: 1870-1914 era and British Hegemony was first era, then after WWII with US led institutions such as United Nations, Security Council, International Trading System etc which are not functioning well.

- Moving from a Unipolar world (where US leads global system) – liberal ideas thrived because they were backed by the US, whereas now the US is retreating.

- Moving to a G2 world – dominated by China and the US. But could be issues arising from their dislike of each other…

- Three other broad macro changes:

- Immediate problem of macroeconomic challenge of moving from low and stable prices over last 30 years and in last years cheap money, to returning to more normal environment of higher rates/inflation. Seeing collapse of banks – macroeconomic uncertainty.

- Demographic change – In East Asia an issue. In Japan population is falling by several million since it peaked at 128m and by 2050 it may only have 85m people. China is also going into reverse. This will shift the balance of power likely towards India.

- Climate change – no one seriously left to be a climate denier, now need to implement change. Need to transition to clean energy which will take lots of investment. Seems to be consensus to deal with this globally but what action next?

- Friedman suggested 15 years ago that globalisation would lead to peace as well – “global arches theory” ie if two countries have McDonalds, they do not fight each other… but now, Putin and the invasion there destroyed that theory. McDonalds now has closed all branches in Russia.

- US and China still need to cooperate on global issues, but for NZ choices will need to be made in the future. For the US Dollar, it is very likely to be eroded in coming years – the rate of change in last 12 months has been massive.

- With the WTO and trading system, is important – there are no FTAs in place among different groups, so NZ needs to ensure further erosion does not happen. Back in 1973 large % of our exports went to the UK. Over time that has changed in last 40 years.

- He remains hopeful for the future.

I enjoyed this session, and it made me remember the themes that came up in the collection of essays I put out “Laying Foundations for Reimagining Business: Essays“.

Andrew Winston: Gigatrends and the drive to net positive

A copy of his book “Net Positive” co-wrtten with Paul Polman was handed out- can an organisation give back more than it uses?

Talking big picture now, what is really driving business. Why are companies having conversations about ESG or their impact on the world.

Remember start of pandemic, when smog reduced across polluted cities, as everything stopped – second week of April, 2020 – gave us a big vision of what is possible.

We can get bogged down in details (policies, decisions, discussions) but need to remember what we are aiming for – a 2050 net zero position.

The last few years have accelerated things – pandemic forced people to think about their employees, customers, suppliers etc. A medical manufacturer released how to make a ventilator so others could do so. The level of discussion on sustainability and the role of business in society was on the table – who are we, who do we serve? Multinationals really have to take a stand on various issues that in the past they may not have taken a position on.

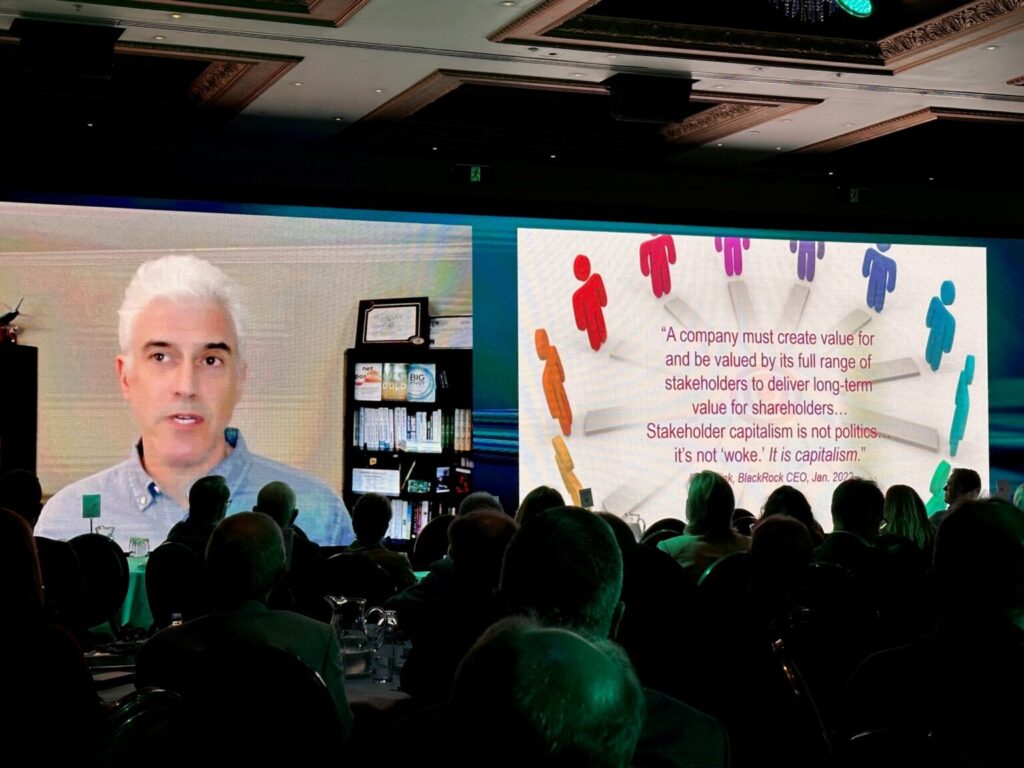

The idea that companies need to say something has grown – surveys show 80% of people think that businesses should take a stand on things like climate change, discrimination, wealth gap etc. Now, the investors are coming to the table – see Larry Fink quote “A company must create value for and be valued by its full range of stakeholders to deliver long term value for shareholders…Stakeholder capitalism is not politics, it’s not ‘woke’.” – we need to understand our impact too. It’s a VUCA – Volatile, Uncertain, Complex, Ambiguous world.

Problems have moved exponentially, a few of these are:

- global income and wealth inequality. 10% of wealthiest owns 75% of the wealth. Those who build spaceships keep getting wealthier.

- climate change as the final exam for humanity. For most there will be massive losses eg cities that will become unliveable – so there will be refugees from cities where they can no longer live. These are really hard questions of what we will do. The cost of doing nothing is much higher than doing something.

- There is good news – massive growth in corporate purchases of renewables as it gets cheaper to build wind/solar sources of energy. This can lead to resilience as well. Growth in electric and hybrid cars has increased with car manufacturers committing to only produce those type in next 10 years.

- Supply chain pressures – need to meet certain targets of carbon emissions in future (penalty approach), compared to suppliers that meet standards, given better lending rates (incentive approach). Others don’t use carrot/stick – to do business, you just have to be able to show sustainability.

The two fundamental megatrends are:

- Rising transparency: In consumer products, people want know what is in the product, carbon footprint, were employees paid enough etc. Move to carbon emission disclosures ie you must report on not just your situation but also scope 3 – how suppliers perform.

- Generational change: The next generation demands it. He has talked about this for 20 years but the real impact is from those coming ie the business case is there, but what do your kids think. Millennials and Gen Z won’t take a job if the company doesn’t have environmental position – so what type of companies will attract and retain talent and customers.

So… opportunity – multi trillion dollar markets that are moving to sustainability. Real change (Gigatrends) v Political theatre (Anti ESG) – even if voices against it, that is not going to stop it. So given scale of problems we have to move faster. Government and Business together. So a net positive business will profit from solving the world’s problems, not creating them.

His co-authored book “Net Positive” with Paul Polman has key points, like ownership – understanding impact of your business – long term perspective not quarterly reporting. Not just getting to a reduction mindset but to actually go to a net positive mindset. Need to think on long term value creation, consider multi stakeholders and think about long term solutions. All this needs courage to implement. Move partnership are opening up and chance to work with others. What are shared hurdles that if you work with suppliers or customers eg Unilever + Unicef working together – not philanthropy or cause related marketing, it is part of the business eg soap that changes colours after 10 seconds so children use it long enough – saves lives.

How is climate affecting business vs how is business affecting climate – which will be reported on? The second will become more important.

To build a thriving world business needs to ensure people and planet thrive as well – how will your business be net positive? The benefits will flow… investing in sustainability will have positive outcomes.

This session also made me think of an interview I did recently for seeds podcast with international journalist Esha Chabra on her book “Working to Restore: Harnessing the Power of Regenerative Business to Heal the World“. Also, the article for IOD on nature and governance here.

Andrew Kempson: Fast Fact on climate change: Methane

Why methane matters – big export for our animal products of meat and milk. So we need to solve this problem to unlock our opportunities (compared to other countries). Methane is a natural process from cows – the vast majority (95%) comes out from mouth of cows, a common misunderstanding is it comes out other end. 1kg of feed creates 21 grams of methane (irrespective of quality of that feed). So could we talk about a reduction of feed to animals (instead of talking about methane) – how do you maintain same amount of meat and milk but feed less? Can you produce same with less feed eg better and high quality feed. Over a 100 year time horizon 1 tonne of methane warms about same as 28 tonnes of carbon – more potent, but more short lived. We are an outlier as it is very important to us so we need to find solution. Farmers need to think more about how they provide less feed into the system so there is less output of methane.

I found this and the other “fast facts” were interesting short sessions to learn more about particular areas – and they broke up what otherwise could have been long back to back sessions.

Reuniting New Zealand: Panel of Adelle Keely, Neil Paviour-Smith, Sanjana Hattotuwa facilitated by Linda Clark

A panel on the topic of reuniting New Zealand – made up of a communications expert, data analyst, and experienced director.

Adelle Keely from Acumen: Have conducted a trust barometer survey – in wealthier countries typically more trust. But first time last year far less trust – so trust in business has lowered but still considered competent and ethical. Regarding where respondents get information from – social media is less trusted, and people are searching rather than “traditional” source such as news articles. Only 1/3 of people think they will be better off in 5 years time – hard to build trust in that environment. High income earners tend to trust – as system working for them. But those in lower economic positon less trusting. Polarisation comes from Economic anxieties, institutional imbalance, trust-class divide, the battle for ‘truth’ – distrust in experts and media. With increased polarisation there is lack of trust and inability to have debate – in NZ there is moderate polarisation compared to other places, but still leads to issues. Ideology is becoming identity: this impacts as people would not help others with opposing view if they are in need. This is not the New Zealand we may think we are… but people do trust their employers. As a result:

- Business must continue to lead the way

- Collaborate with Government on new issues such as AI

- Restore economic optimism with fair wages

- Advocate for truth and being source of reliable information

These factors will help towards hope and optimism.

Neil Paviour-Smith: As a director what does all this mean? Disinformation has always existed but the internet has magnified its power. This is becoming more mainstream and it corrodes our system in different ways and erodes trust in institutions and people less likely to comply with rules. You need to have trust to be able to succeed. Why is it that we continue to publish home addresses of directors on Companies Office site – this should change. Disinformation is a risk that needs to be on our agendas as businesses. There can be an insidious undermining of a reputation – so what part of my company is most at risk to these issues? If high profile may be more at risk of being targeted. What parts of our business will be hurt by disinformation? How would we respond to an attack? We need to be asking these questions about disinformation now and put on risk register.

Sanjana Hattotuwa: Been observing data related to Covid-19 – Research Fellow on The Disinformation Project. Trust is important – after the pandemic, there is a societal challenge on Trust vs Truth. Construction of engineered anger, sustained by social media and highly intentional and strategic. Disinformation is a campaign just like advertising – it is everywhere and about everything and will be enduring. We need to think about what is coming, and where the future will be such as in relation to generative AI – will change how we see the world and make it hard to distinguish between fact and fiction. Disinformation as a service may happen to target something. We haven’t thought it through yet, and it needs to be in our risk matrix as it is evolving very quickly.

We consume a lot of offshore content so shouldn’t surprise us to see influence here.

This session generated a lot of talk at the conference over lunch and afterwards that a summary like this cannot convey, but at least you get a sense of what was talked about.

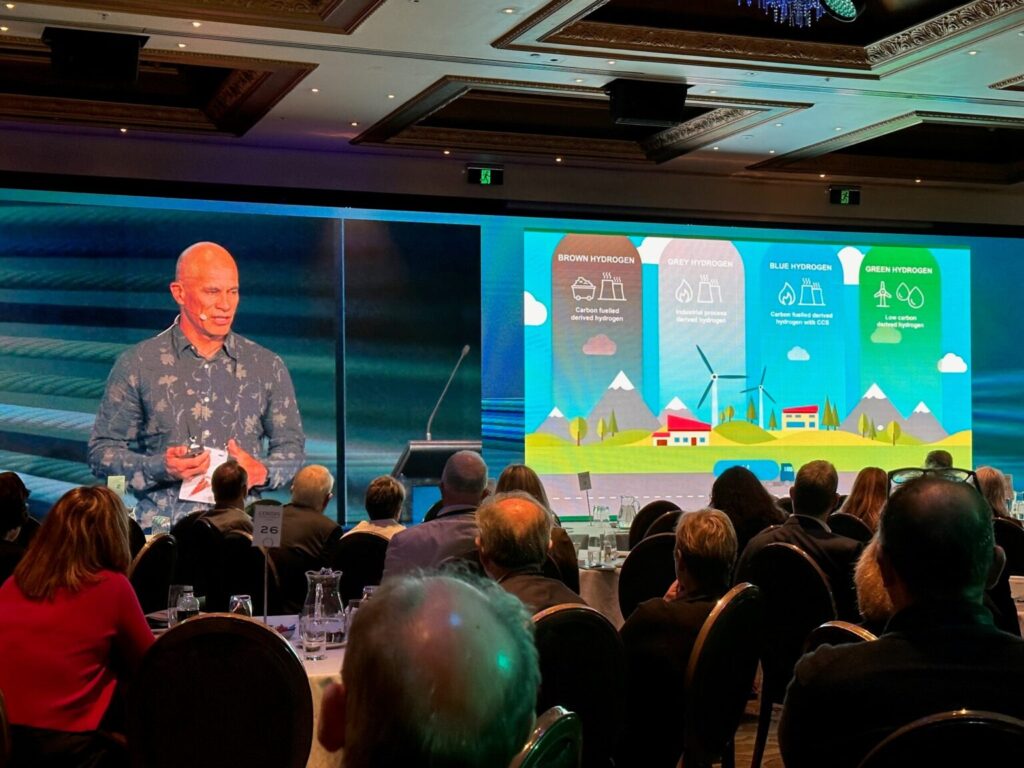

Guy Waipara: Fast Fact on climate change: Hydrogen

Most abundant element – periodic table is number 1. Lightest element. From energy perspective we are very interested in it. The sun is 90%+ hydrogen. It’s in carbon fuels, and in water. It is energy intense and it is light – occupies large volume. There are different types of hydrogen – green, brown, grey, blue. Green hydrogen is growing in conversation and importance. Opportunity to greenify from fossil fuels with hydrogen is substantial. Or moving from fossil fuel based fertiliser to green fertiliser. Process of making steel needs coal, so instead of using that could you use hydrogen and release water vapour instead. Could be used in aviation, could be used in transport and hydrogen fuel cell trucks, could be used in electricity generation. So there is a massive opportunity here overseas and here as well. Key challenge for hydrogen is that it is expensive to make – could there be subsidisation, learning curve and then efficiencies will come. Meridian is looking for opportunities in Deep South – large scale export facility in Bluff, deep water port and move away from old Tiwai point aluminium smelter that is closing down. So there is a future around Hydrogen – let’s see what comes next as with technology it could be taken anywhere. Many hydrogen sceptics but many believers too – start with easy use cases, and there will be opportunities ahead.

Sir Brian Roche: Fast Fact on climate change: Antarctica

Antarctic is very large – double the size of Australia – and Christchurch is one of the 5 gateway cities. It is governed by a multilateral treaty so many voices and decisions by consensus. New Zealand is one of the founding nations. It is important because of security, geo-politics, science and weather. Antarctica is important for global climate change – if the snow and ice melted then sea levels would rise by 60 metres. The ocean currents connect with all other oceans in the world so it impacts elsewhere as well. There are signs of negative change eg Southern Ocean Krill – at base of food chain and then it flows up as fish eat them. With low pH level it will impact them. We need to raise voice and profile on the science. We are the custodians of this place, we need to care for it. So we need to do tangible things to change the course of this. Next steps will include refurbished Scott Base with an ongoing presence there with increased science.

An interactive session on NFP governance hosted by Dr Jim Mather with panel of Graham Shaw, Dame Fran Wilde, Martin Snedden and Dame Kerry Prendergast

Dame Kerry: NFP are not any different from other boards – need strategy, objectives, plan. But you may have board members who have little experience and want to run organisation, unpaid and not necessarily subject experts. Often risk averse and cautious and little appetite for risk. Executive often small doing many jobs. Constantly have to be fundraising.

Dame Fran: no organisation is the same – large national ones vs tiny ones. Driven by delivering mission, rather than delivering profit.

Graham: foundations of governance across any organisation are same. People may join a board for their own benefit and own ends. Regarding faith sector, there is a spiritual side – ie a higher purpose. The ‘purpose’ and ‘how’ can get mixed up – need to understand a “call” to serve.

Martin: choosing a board you need to really believe in it otherwise you’ll lose interest. Need to celebrate being involved. There is risk involved in governance and what you may need to deal with – good governance often solves the issues. You need the heart to get involved and ‘ride the wave’.

Other points:

- it’s an opportunity to give back and enjoy the people you work with

- sometimes shoulder tapping new governance is good idea

- but instead of this leading to friends only, have a skill matrix as well

- offer to go along and be mentored before joining

- are you independent or hands on governance? Blurs governance and management

- Important that relationships are clear – it may be important that it starts with people more involved

- the importance of role of the Chair – help governors to hold management to account

- management does a good job, governance ensures a good job is done

- often NFP boards are much harder – but opportunities are greater to join them so may

- should members choose new board members, or should board choose

- if you are reliant on donations then how do you operate – are you a going concern? It can get tricky

- inductions could provide more information eg framing of purposes and what they are

- an induction may take a year – learn as the year goes on

- be open to questions ie allow people to ask more

- use community trusts to hold your funds that will use it for what you asked it to be used for

- terminology – I asked a question about whether terminology was important and could it be “for purpose” sector instead of “not for profit” (something I have written on this is here: ‘Not for profit’ or ‘For purpose’? Some reflections by way of Star Trek – seeds (theseeds.nz)

I enjoyed this session and really thought the emphasis that these governance positions are not “easier” was important – reminded me of an article my friend Justin Stevenson did recently for the IOD on the topic over here.

It also made me remember this paper I did with Craig Fisher on “A framework for thinking about change: 7 hard questions Charities should be asking“

Jason Fox: Into the Storm

Started out talking about introversion and extroversion – a lot on offer today to process and think about. What if your life was an autobiography in a book – what has been the theme in your story in the last one or two years? Would you feel excited, frustrated, repetitive? What would that word be? (It is the most interesting conversation you can have – about yourself…). This is a way to get a metaperspective.

Often people say ‘busy’ – we can become too busy so we do not make progress, as the boundaries between work and home have disappeared, influenced by advertising platforms we call social media. It makes us feel like we are busy and time poor and so we favour default ways of doing things. Our defaults are the way we do things automatically. We may also choose the safe options…

Experienced leaders have lots of defaults – we have quick answers and fix it but can lead to loss of new thinking. Start-up -> Growth -> Maturity -> Decline. At that start-up phase it is curiosity which drives us. Later on we stop engaging in the World as we mature and then decline, because we become irrelevant. If we become too busy for meaningful progress. How do we avoid the decline? The Kraken of doom…

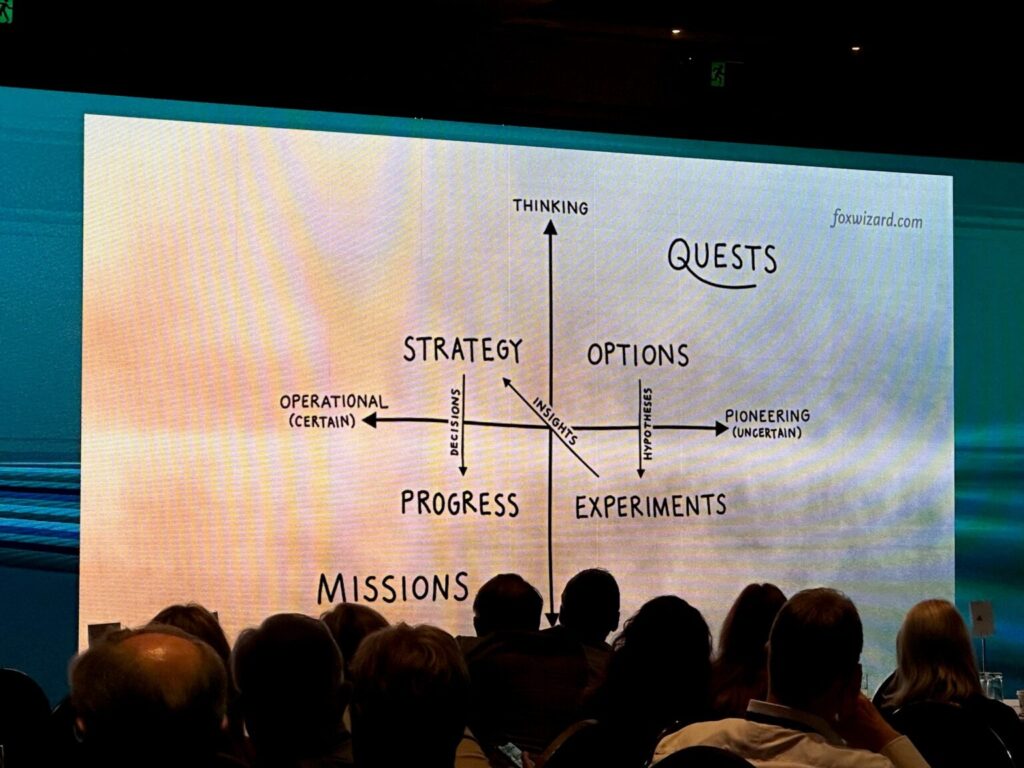

Most leadership works within certain paradigms. Setting targets, work out where we are going. But what if we don’t know where our destination is?

Great work involves curiosity, empathy and effort. Five things get you enthusiastic to do great work: Recognition, interpersonal support, clear goals and targets, clear sense of purpose, recognition for good work? Research shows probably the last one ie you need to recognise what people have done. So also need short feedback loops so people get their feedback quickly. Our focus will naturally gravitate to those things that have richest sense of purpose. We might even write down things we have already done – just so we can cross them off.

What is it that provides a rich sense of purpose? Need to know what this is. Rather than patch together things stop focussing on things that provide rich delusion of progress. We might value effort rather than actual value – a pantomime of busyness. Innovation theatre, leadership theatre, governance theatre – could we get rid of the delusion of progress?

What if we thought of things like a Quest? See diagram below. Strategy often is just tweaking what we did already last year ie no more breakthrough and transformation.

We actually want optimal conflict – we need to ask hard questions. What are the options open to us – some trends, glimmers on horizon you are paying attention to? What science fiction are you reading at the moment? Trying to get your thinking out of old ways…

Chooseoneword.com – how would you choose one word for coming year to guide you as a beacon? What would it be?

While questing precedes strategy, fellowship precedes questing… how can we cultivate conditions for decency in our organisations?:

- Defaults are options chosen automatically in the absence of viable alternatives

- A quest is the search for viable alternatives (beyond the default)

- Questing precedes strategy (and fellowship precedes questing)

All leadership happens in the place of paradox – be OK with being in that place. Foster different ways of measuring success rather than traditional metrics.

We all make choices but in the end, our choices make us. For some reason this session made me remember the interview I did with Frances Valentine on the power of being curious here.

Kirsten Patterson: Closing Day 1

A question to leave us with: When was the last time you actually properly changed your mind?

Expand your mind, experience new ideas. Meet someone new.

IOD advocates for change – including removing personal addresses from Companies Office register.

The 2024 conference will be in Otautahi Christchurch on 13-14 May.

David Downs evening function

This was a fun evening event all about New Zealand! We had a quiz about things we may not have known and heard about innovations and things which help us stand out. Funny and insightful!

For more check out the videos and info over here New Zealand Story (nzstory.govt.nz)

The “Social” in ESG: Breakfast Panel on day 2

A panel led by Jackie Lloyd with Dr Helen Anderson, Tania Te Rangingangana Simpson and Craig Stobo. The panel offered these reflections on what the social is, because it is often left out of the discussion (the other breakfast sessions were on the “E” and the “G”):

What is the “S” in ESG? It is hard to define – but basically is anything to do with people. Externally, we are not just serving the shareholders but it will depend on the Board. But always need to ask who are the long term beneficiaries? In New Zealand a very important aspect will be engagement with Mana Whenua.

People part and how we look after our people – our employees who are struggling to survive. So if we employ at low wages, are we really looking after them? How are we impacting so how can we leverage the positive and minimise negative impact on our people. More and more people are choosing where to invest and while the “E” is a big one, the “S” is growing in importance.

What if Business was to produce profitable solutions to the problems of people and the planet… that would change how we approach the “S”. It covers employment, customer satisfaction, impact on society. This needs to be more than ‘demonstrated’ it has to actually be done.

The panel also talked about other issues but under Chatham House rules so haven’t included it all.

Panel on relationship between CEO and Board Chair facilitated by KP, with Dame Therese Walsh and Greg Foran regarding Air NZ

Greg began as the pandemic started. It was a turbulent time – so there was a need to “panic slowly” – the Board had to make sure they were not making decisions without data to do so. It has been hard to forecast what was going to happen next with Covid. Regarding the relationship between Chair and CEO, they had to just get on quickly due to urgency of the situation.

How did you build trust in crisis conditions? Had talks from the start about full transparency – that is CEO doesn’t manage Chair, and Chair doesn’t manage CEO – trust is the key. Both passionate about success of the airline and despite not knowing each other, realised more communication would be needed at the start. This included early morning conversations. Constant communication was key. You build trust by the person doing what they say they will do.

How about after the crisis? How do you get to a steady state? Similar to above but less volume of communication. The more you do what you say you will do, the easier it becomes and you get into a cadence. You have to work at it, this won’t happen by chance. Do have more of a fortnightly rhythm to connect and discuss. Always be up front and disclose information.

How do you respect the governance vs management divide: Directors do pass feedback and keep in touch about things that are related to smaller details, and CEO takes information. It is important to not go too far but it is also important for Directors to be aware of conditions on the ground.

How about conflict? The key to reducing conflict is constant communication and transparency – things don’t come up first time in a board meeting, they are talked about earlier. What does ‘no surprises’ mean? Generally a view of ‘more is less’ means that enough information is passed on.

How do you ensure that you do not become a board of two? The Board is the decision making unit and the Chair is relatively less power so it needs to go to whole Board. Cannot lose sight of fact Board makes decisions. Directors ask questions in Board meeting etc. But important that CEO and Chair not be in conflict otherwise will not move forward. Also it is important to have board only time.

When was the last time you changed each other’s mind? As they share all the time this happens naturally and so with that it is not aggressive and relationship is respectful, so both perspectives are discussed and if they sense it won’t be clear cut decision they begin process to understand each side. So it happens quite organically that they are influencing each other and it evolves over time.

Ann Sherry: Lessons learnt from a leading director

The challenges of governance from an Australian perspective:

- Engagement increasing with many more than just shareholders – so stakeholder engagement needs to improve. That is what keeps her up at night.

- Cyber and tech – you need to understand it as the damage to individuals is massive eg change phone numbers, private health records, new licenses needed. The hackers are better organised than we are. We all have legacy systems that are vulnerable. Do we actually need all the details we collect? “It might be useful” is not good enough.

- Bullying and sexual harassment – these are cultural markers and Directors are increasingly responsible.

- Skills shortage – the workforce is shrinking, there are just fewer people available, so we need to retrain people to plug gaps. A mindset shift to retrain our people. And recognise

- Reconciliation – relationship different but Australia could learn from NZ on eg cogovernance. Need to hear firsthand from people rather than rely on “we’ve consulted”.

- NFP – post Covid cyber world, less amounts being given. Need same capability as other boards. They may be hacked too.

- How to reverse brain drain? Brisbane has many Kiwis, it’s a bigger sector and wages higher, perhaps less binary approach ie people moving more fluidly. Change the conversation?

So we have to be deliberate to think of the risks we are facing! Be risk anticipators…

The future of health with Tipa Mahuta, Vanessa Stoddart coordinated by Ross Buckley.

- Health touches us all and reforms are important. There are many dynamics in this with 80,00 staff but through funding influence 200,000 with a budget of 24 billion it’s huge. Partner with MOH and Iwi and Community and Staff.

- Size and scale: Huge, across IT, Staff, Property. There are many challenges.

- They work together at leadership level to ensure joint meetings and people sitting across boards.

- operating with principles of Hauora Māori. Hard to start something new while also delivering.

- when challenged you need to stand up for each other. Need breadth of experience across team. Extend opportunities for learning. Try new ways to connect eg wananga.

- reform of public sector area is not for the faint hearted. Classic governance principles not same.

- listen, consider conflicts, make choices – coping with sad implications as you cannot help all. Stay focussed on the goal.

- need to have long term Inter generational perspectives. Need to be innovative and using new technology. Need to support each other.

- The health system needs reform, so need to work together to make it a success as it will help us all have great health outcomes.

Dominic Barton: Global governance insights (chair of Rio Tinto)

The changing world we are in:

It feels like we are always in historic times but the amount of change is just extraordinary, such as:

- challenge of energy transition and an opportunity – it’s a transition that’s not a straight line. An economic shift to Asia, but we are acting like it’s 1990s but change has happened. Technology changing very quickly.

- Globalisation will be very different, still unsure impact.

- Changes in capital markets -> move to private capital. Many more focused on bonds compared to equity. Rise of the Middle East as economic centre and capital.

- increasing polarisation of poor and wealthy. Will create instability.

- Media misinformation and disinformation that can accelerate changes.

It’s implications on business:

- what is your ambition level – without high ambition you won’t be relevant.

- resource allocation, need to think about 5-7% resource reallocation

- speed – why go by quarters or years, move faster

- non traditional competitors emerging

- importance of social license – it matters, how do you do it well?

- organisation redesign – reposition how we operate particularly for large multinationals

- simplicity. How do we keep it?

- how do we retain and recruit talent

- need to challenge orthodoxy and be ready for change. Some quotes:

- don’t act with yesterday’s knowledge

- in a moment of crisis the wise build bridges and foolish build dams

- a ship is safe in the harbour – but that is not what it was made for

What it means for governance?:

- strategy is very important but often underdone

- risk management – think about what is consequence after the initial shock

- do we need new roles on boards eg Government communications and what skills? Technology committee?

- CEO / Chair succession, how you think about it – what is the process?

- Culture – how do you measure it?

These are many new dimensions to think about as leaders to challenge orthodoxy.

Julia Hoare shared final thoughts:

Connections have been forged, and we have met many and had challenges. Good governance can be transformational. Engagement has been high at this conference – many issues discussed across geopolitical, cyber, climate, disinformation … a lot to reflect on! Hope the conference has inspired us to try something different. Don’t sit still as we each contribute to good governance….

Dr Jim Mather closed with Karakia.

* * * * * * *

Thanks Hannah Duder for letting me post your comments on Day 1 here too so you get another perspective as well! Her lessons learned as a Founder are over here for seeds, and she reflected as follows:

“We are too busy for meaningful progress.” – Dr Jason Fox

Day two of the Institute of Directors in New Zealand Leadership Conference is about to start so I thought I would take some time to reflect on day one.

To tackle some of the biggest issues we are facing as a nation we need realism and a shared degree of commitment from the two major parties to find solutions that we can maintain over more than just the electoral cycle.

“Cost of Inaction > The cost of action

When discussing businesses’ role and responsibility regarding climate change.

We are living in a VUCA world – Volatile, Uncertain, Complex, and Ambiguous. A time of very serious problems but vast opportunities.

64% of millennials won’t take a job if the company doesn’t have strong Corporate Social Responsibility values – Millennials.

We must go bigger and much faster. It’s not enough to be less bad.

Sustainability pays if you understand the real value. This is how we THRIVE, your business can’t thrive unless people and planet are thriving are well. How will you be Net Positive? “

A great presentation by the author of Net Positive – Andrew Winston.

The final speaker of the day was the philosophical wizard Dr Jason Fox who concluded that we do not have enough time to think, and if you aren’t thinking you are going to have meaningful progress.

A breakthrough idea from a study into retaining employees – show them clear progress.

We love seeing progress.

So grateful to the Asia New Zealand Foundation for sending me to this conference and helping me continue my governance journey.”

–

Enjoy the content? Sign up for the newsletter at www.theseeds.nz and check out the 346 podcast episodes for seeds!

Note the Seeds Impact Conference is coming up online in October, check it out (only $20 to attend and seeking more supporters, now with 160 on the site including IOD).

And check out Board Matters podcast here.

Check out the Idealog article here Emerging trends from IOD Governance Conference – Idealog